Protect What Matters

Richard S. Bernstein & Associates, Inc.

Incorporating life insurance into a broader financial plan can help individuals and families address multiple financial needs: protecting loved ones, creating wealth, ensuring tax-efficient growth, and planning for future healthcare costs. When strategically used, it is a versatile financial tool that not only provides peace of mind but also plays a key role in achieving long-term financial security.

Richard Bernstein & Associates, Inc. is an independent financial services firm, specializing in helping individuals and families utilize life insurance to provide a death benefit for loved ones, shield assets from probate and unnecessary taxation, optimize retirement savings, and secure tax-free income in support of a holistic financial plan.

01

Start Smart

Protect your Assets

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives by providing liquidity for you and your family.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Liquidity Strategy Designed for You

03

Communicate Progress

Our Commitment to You

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Question or Comment

Here For You

Meet The Team

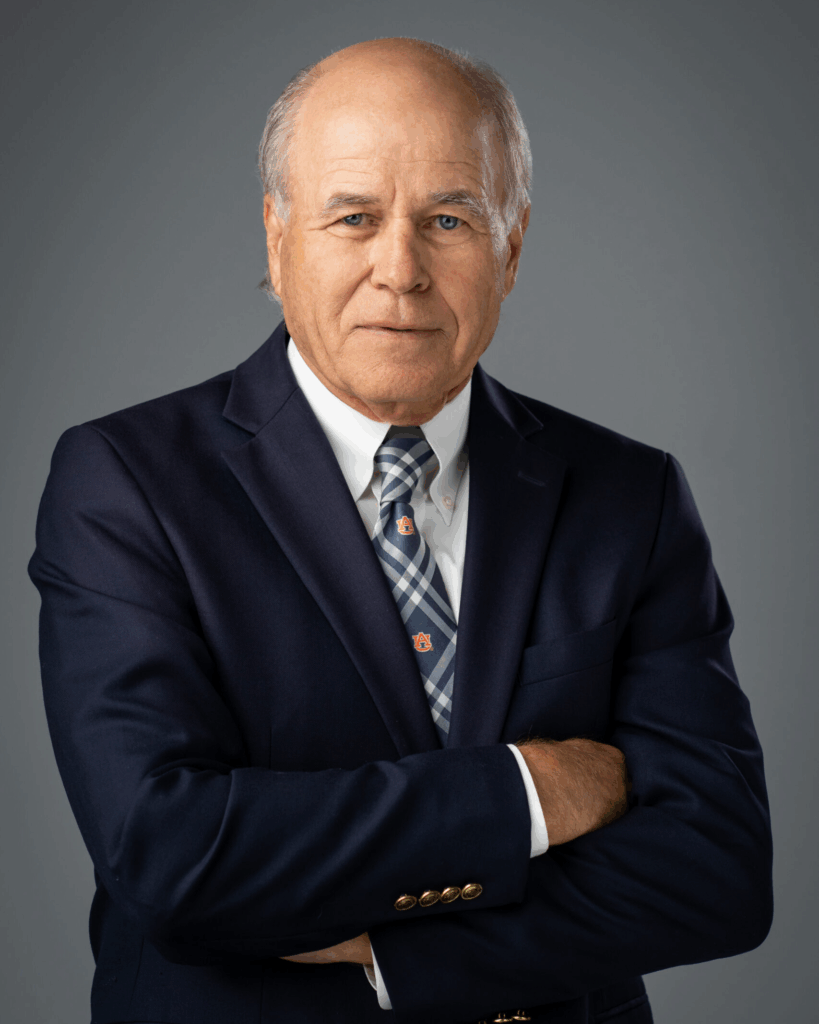

Richard S. Bernstein

Chief Executive Officer Bernstein & Associates, Inc.

Richard S. Bernstein, Chief Executive Officer of Richard S. Bernstein & Associates, is an insurance advisor for high net worth business leaders and families as well as charitable organizations. Mr. Bernstein is known for being at the leading edge of the insurance industry as a life insurance agent and as the founder of Richard S. Bernstein and Associates, Inc.

A former insurance advisor to the Trump Organization as well as many of America’s wealthiest families, Mr. Bernstein draws on more than 50 years of experience in financial services. He has a been nationally recognized by his peers for his knowledge, innovation, and expertise.

Richard is a longtime member of the Top of the Table and The International Forum – professional industry associations formed to exchange diverse ideas and expertise of the leading life insurance professional in the world. Mr. Bernstein graduated in 1964 from the University of Miami with a Bachelor of Arts in Finance, having earned the J. Edwin Larson Scholarship in insurance studies.

Client Testimonials

SP

Strategic Planning

Our Commitment to You

Our Upcoming Events

Educational Events

Events in February 2026

- There are no events scheduled during these dates.

Client Events

Events in February 2026

- There are no events scheduled during these dates.